Your Comprehensive Financial Solution for Retirement

Sun Life Financial aims to serve the workforce in Hong Kong by providing comprehensive financial solutions for their retirement. To accomplish this long term goal, Sun Life Rainbow MPF Scheme (the “Scheme”) is specifically designed to meet different needs of Hong Kong employers, their employees and self-employed persons by providing one-stop services on pensions scheme management, including trustee, administration and investment management.

Key Benefits

Multi-Manager Investment Approach

This approach can effectively reduce concentration risk by not relying on a single underlying fund manager and enables our members to benefit from investment expertise from around the world.

18 Constituent Fund Choices

To meet different retirement needs and goals of our members, the Scheme offers 18 constituent funds.

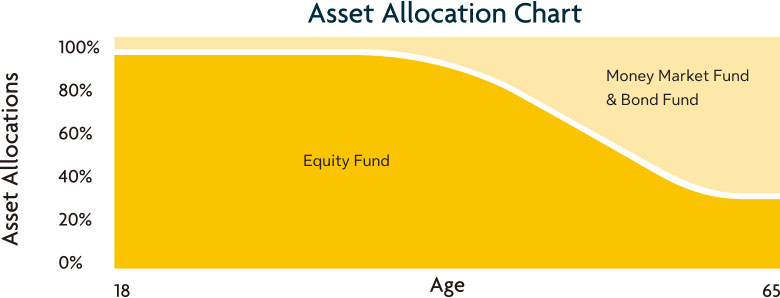

Fund Cruiser

This program adopts a pre-determined asset allocation method⁵, which automatically rebalances your MPF portfolio every year according to your age on your birthday⁶.

Default Investment Strategy (DIS)

This is a ready-made investment arrangement as stipulated in accordance with the Mandatory Provident Fund Schemes Ordinance mainly designed for those members who are not interested or do not wish to make a fund selection.

Experts Managing Your MPF Scheme

Professional team managing your MPF scheme includes:

- Trustee – Sun Life Trustee Company Limited

- Sponsor – Sun Life Hong Kong Limited

- Custodian – The Hongkong and Shanghai Banking Corporation Limited

- Administrator – BestServe Financial Limited

- Investment Manager – Sun Life Asset Management (HK) Limited ¹

Sun Life Asset Management (HK) Limited - Introducing Multi-Manager Investment Approach

Sun Life Asset Management (HK) Limited (“Sun Life Asset Management”) is a wholly-owned subsidiary of Sun Life Hong Kong Limited. In order to pursue sustainable long-term performance, Sun Life Asset Management introduced multi-manager investment approach to the Scheme. Under our multi-manager platform at the underlying fund level, a constituent fund is a portfolio management fund investing in different approved pooled investment funds (“APIF”) and/or approved index-tracking collective investment schemes (“Approved ITCIS”). This approach allows Sun Life Asset Management, based on various factors, such as investment styles of underlying funds and market conditions, to actively allocate assets among performing underlying fund managers. In addition, this approach can effectively reduce concentration risk by not relying on a single underlying fund manager and enables our members to benefit from investment expertise from around the world. Currently, 12 out of 18 constituent funds have adopted this approach.

Constituent Fund Choices

To meet different retirement needs and goals of our members, the Scheme offers 18 constituent funds. The following summary of constituent fund choices includes the investment objective and investment mix of each constituent fund available under the Scheme.

Name of Constituent Fund |

Investment Objective 2 |

Investment Focus 2 |

Managed by Multi-manager Investment Approach |

|---|---|---|---|

| Sun Life MPF Conservative Fund | Seeks to provide members with a regular increase in value, with minimal risk to the underlying capital but with no guarantee of repayment of capital | Hong Kong dollar money market instruments, cash deposits and short-term corporate and government debt securities | No |

| Sun Life MPF Hong Kong Dollar Bond Fund | Seeks to provide members with a return in excess of that achievable from bank deposits and money market securities | At least 70% in Hong Kong dollar denominated bonds and debt instruments | Yes |

| Sun Life MPF RMB and HKD Fund | Seeks to achieve long-term total returns | 30% - 70% in RMB denominated fixed income/money market investments, 30% - 70% in HKD denominated fixed income/money market investments | No |

| Sun Life MPF Global Bond Fund | Seeks to provide members with total return usually in excess of that achievable from bank deposits and money market securities | Bonds and other debt instruments | Yes |

| Sun Life MPF Stable Fund | Seeks to provide members with steady capital growth | 50% - 90% in fixed income/money market investments, 10% - 50% in equity investments | Yes |

| Sun Life MPF Balanced Fund | Seeks to provide members with moderate capital growth over the medium term to longer term | 30% - 70% in fixed income/money market investments, 30% - 70% in equity investments | Yes |

| Sun Life MPF Growth Fund | Seeks to provide members with significant capital growth over the medium term to longer term | 10% - 50% in fixed income/money market investments, 50% - 90% in equity investments | Yes |

| Sun Life MPF Global Low Carbon Index Fund4 | Seeks to provide members with investment result that, before fees and expenses, closely track the performance of the FTSE Custom MPF Developed Selected Countries ESG Low Carbon Select Hedged Index | Global equities | No |

| Sun Life MPF Multi-Sector Equity Fund | Seeks to achieve long-term capital growth | Global equities | Yes |

| Sun Life MPF European Equity Fund | Seeks to provide members with long-term capital growth | At least 70% in European equities | Yes |

| Sun Life MPF Asian Equity Fund | Seeks to provide members with long-term capital growth | At least 70% in Asian equities | Yes |

| Sun Life MPF US Equity Fund | Seeks to provide members with long-term capital growth | At least 70% in US equities | Yes |

| Sun Life MPF US & Hong Kong Equity Fund | Seeks to achieve long-term capital growth | 90% - 100% in equities (50% - 70% in United States and 30% - 50% in Hong Kong), 0% – 10% in cash or cash equivalents | Yes |

| Sun Life MPF Greater China Equity Fund | Seeks to achieve long-term capital growth | At least 70% in Greater China equities | Yes |

| Sun Life FTSE MPF Hong Kong Index Fund³ | Seeks to provide members with investment result that, before fees and expenses, closely track the performance of the FTSE MPF Hong Kong Index | Hong Kong equities | No |

| Sun Life MPF Hong Kong Equity Fund | Seeks to provide members with long-term capital growth | At least 70% in Hong Kong equities | Yes |

| Sun Life MPF Core Accumulation Fund | Provide capital growth to members | 55% - 65% in global equities, 35% - 45% in fixed income/money market investments | No |

| Sun Life MPF Age 65 Plus Fund | Provide stable growth to members | 15% - 25% in global equities, 75% - 85% in fixed income/money market investments | No |

| No. | 1 |

Name of Constituent Fund |

Sun Life MPF Conservative Fund |

| Investment Objective² | Seeks to provide members with a regular increase in value, with minimal risk to the underlying capital but with no guarantee of repayment of capital |

| Investment Focus ² | Hong Kong dollar money market instruments, cash deposits and short-term corporate and government debt securities |

| Managed by Multi-manager Investment Approach | No |

| No. | 2 |

Name of Constituent Fund |

Sun Life MPF Hong Kong Dollar Bond Fund |

| Investment Objective ² | Seeks to provide members with a return in excess of that achievable from bank deposits and money market securities |

| Investment Focus ² | At least 70% in Hong Kong dollar denominated bonds and debt instruments |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 3 |

| Name of Constituent Fund | Sun Life MPF RMB and HKD Fund |

| Investment Objective ² | Seeks to achieve long-term total returns |

| Investment Focus 2 | 30% - 70% in RMB denominated fixed income/money market investments, 30% - 70% in HKD denominated fixed income/money market investments |

| Managed by Multi-manager Investment Approach | No |

| No. | 4 |

| Name of Constituent Fund | Sun Life MPF Global Bond Fund |

| Investment Objective ² | Seeks to provide members with total return usually in excess of that achievable from bank deposits and money market securities |

| Investment Focus ² | Bonds and other debt instruments |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 5 | |

| Name of Constituent Fund | Sun Life MPF Stable Fund | |

| Investment Objective ² | Seeks to provide members with steady capital growth | |

| Investment Focus ² | 50% - 90% in fixed income/money market investments, 10% - 50% in equity investments | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 6 | |

| Name of Constituent Fund | Sun Life MPF Balanced Fund | |

| Investment Objective ² | Seeks to provide members with moderate capital growth over the medium term to longer term | |

| Investment Focus ² | 30% - 70% in fixed income/money market investments, 30% - 70% in equity investments | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 7 |

| Name of Constituent Fund | Sun Life MPF Growth Fund |

| Investment Objective ² | Seeks to provide members with significant capital growth over the medium term to longer term |

| Investment Focus ² | 10% - 50% in fixed income/money market investments, 50% - 90% in equity investments |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 8 | |

| Name of Constituent Fund | Sun Life MPF Global Low Carbon Index Fund4 | |

| Investment Objective ² | Seeks to provide members with investment result that, before fees and expenses, closely track the performance of the FTSE Custom MPF Developed Selected Countries ESG Low Carbon Select Hedged Index | |

| Investment Focus ² | Global equities | |

| Managed by Multi-manager Investment Approach | No |

| No. | 9 | |

| Name of Constituent Fund | Sun Life MPF Multi-Sector Equity Fund | |

| Investment Objective ² | Seeks to achieve long-term capital growth | |

| Investment Focus ² | Global equities | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 10 | |

| Name of Constituent Fund | Sun Life MPF European Equity Fund | |

| Investment Objective ² | Seeks to provide members with long-term capital growth | |

| Investment Focus ² | At least 70% in European equities | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 11 | |

| Name of Constituent Fund | Sun Life MPF Asian Equity Fund | |

| Investment Objective ² | Seeks to achieve long-term capital growth | |

| Investment Focus ² | At least 70% in Asian equities | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 12 | |

| Name of Constituent Fund | Sun Life MPF US Equity Fund | |

| Investment Objective ² | Seeks to achieve long-term capital growth | |

| Investment Focus ² | At least 70% in US equities | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 13 | |

| Name of Constituent Fund | Sun Life MPF US & Hong Kong Equity Fund | |

| Investment Objective ² | Seeks to achieve long-term capital growth | |

| Investment Focus ² | 90% - 100% in equities (50% - 70% in United States and 30% - 50% in Hong Kong), 0% – 10% in cash or cash equivalents | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 14 | |

| Name of Constituent Fund | Sun Life MPF Greater China Equity Fund | |

| Investment Objective ² | Seeks to achieve long-term capital growth | |

| Investment Focus ² | At least 70% in Greater China equities | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 15 | |

| Name of Constituent Fund | Sun Life FTSE MPF Hong Kong Index Fund³ | |

| Investment Objective ² | Seeks to provide members with investment result that, before fees and expenses, closely track the performance of the FTSE MPF Hong Kong Index | |

| Investment Focus ² | Hong Kong equities | |

| Managed by Multi-manager Investment Approach | No |

| No. | 16 | |

| Name of Constituent Fund | Sun Life MPF Hong Kong Equity Fund | |

| Investment Objective ² | Seeks to provide members with long-term capital growth | |

| Investment Focus ² | At least 70% in Hong Kong equities | |

| Managed by Multi-manager Investment Approach | Yes |

| No. | 17 | |

| Name of Constituent Fund | Sun Life MPF Core Accumulation Fund | |

| Investment Objective ² | Provide capital growth to members | |

| Investment Focus ² | 55% - 65% in global equities, 35% - 45% in fixed income/money market investments | |

| Managed by Multi-manager Investment Approach | No |

| No. | 18 | |

| Name of Constituent Fund | Sun Life MPF Age 65 Plus Fund | |

| Investment Objective ² | Provide stable growth to members | |

| Investment Focus ² | 15% - 25% in global equities, 75% - 85% in fixed income/money market investments | |

| Managed by Multi-manager Investment Approach | No |

Fund Cruiser

If you don’t want the burden of having to manage your investment portfolio on a regular basis, you can consider joining Fund Cruiser. This program adopts a pre-determined asset allocation method⁵, which automatically rebalances your MPF portfolio every year according to your age on your birthday⁶. This is a feature specially designed for those members who have less investment experience or lack time to manage their MPF portfolio.

In order to diversify your MPF portfolio, the following constituent funds are selected under Fund Cruiser:

| Fund Descriptor | Name of Constituent Fund |

|---|---|

| Money Market Fund – Hong Kong | Sun Life MPF Conservative Fund |

| Bond Fund – Hong Kong | Sun Life MPF Hong Kong Dollar Bond Fund |

| Equity Fund – Hong Kong | Sun Life MPF Hong Kong Equity Fund |

| Equity Fund – Global Equities | Sun Life MPF Multi-Sector Equity Fund |

Note: Members should note that the pre-determined asset allocation under “Fund Cruiser” is a standard arrangement only and does not constitute any investment advice to individual members. The arrangement does not take into account factors other than age, which members may also need to consider, such as their investment objectives, financial needs, risk tolerance, market and economic situations.

Management Fees and Payment for Services Relating to Default Investment Strategy (“DIS”)§

| Name of Constituent Fund | Management fees⁶ (as a % of p.a. of NAV) | ||

|---|---|---|---|

| Class A | Class B | No Class of Unit | |

| Sun Life MPF Conservative Fund | Up to 0.883% | Up to 0.883% |

N/A |

| Sun Life FTSE MPF Hong Kong Index Fund | Up to 0.963% | Up to 0.963% | N/A |

| Sun Life MPF RMB and HKD Fund | Up to 1.223% | Up to 1.173% | N/A |

| Sun Life MPF Hong Kong Dollar Bond Fund | Up to 1.398% | Up to 1.398% | N/A |

| Sun Life MPF Global Bond Fund | Up to 1.748% | Up to 1.548% | N/A |

| Sun Life MPF Hong Kong Equity Fund | Up to 1.748% | Up to 1.548% | N/A |

| Sun Life MPF Stable Fund | Up to 1.748% | Up to 1.548% | N/A |

| Sun Life MPF Balanced Fund | Up to 1.748% | Up to 1.548% | N/A |

| Sun Life MPF Growth Fund | Up to 1.748% | Up to 1.548% | N/A |

| Sun Life MPF Asian Equity Fund | Up to 1.893% | Up to 1.693% |

N/A |

| Sun Life MPF Multi-Sector Equity Fund | Up to 1.778% | Up to 1.578% | N/A |

| Sun Life MPF Greater China Equity Fund | Up to 1.943% | Up to 1.743% | N/A |

| Sun Life MPF Global Low Carbon Index Fund | N/A | N/A | Up to 1.10% |

| Sun Life MPF European Equity Fund |

N/A | N/A | Up to 1.305% |

| Sun Life MPF US Equity Fund |

N/A | N/A | Up to 1.285% |

| Sun Life MPF US & Hong Kong Equity Fund | N/A | N/A | Up to 1.103% |

| Name of Constituent Fund | Payment for services relating to DIS§ (as a % of p.a. of NAV) |

|---|---|

| Sun Life MPF Core Accumulation Fund | Up to 0.733% |

| Sun Life MPF Age 65 Plus Fund | Up to 0.733% |

| No. | 1 | |

| Name of Constituent Fund | Sun Life MPF Conservative Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 0.883% |

| Class B | Up to 0.883% | |

| No Class of Unit | N/A | |

| No. | 2 | |

| Name of Constituent Fund | Sun Life FTSE MPF Hong Kong Index Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 0.963% |

| Class B | Up to 0.963% | |

| No Class of Unit | N/A | |

| No. | 3 | |

| Name of Constituent Fund | Sun Life MPF RMB and HKD Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.223% |

| Class B | Up to 1.173% | |

| No Class of Unit | N/A | |

| No. | 4 | |

| Name of Constituent Fund | Sun Life MPF Hong Kong Dollar Bond Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.398% |

| Class B | Up to 1.398% | |

| No Class of Unit | N/A | |

| No. | 5 | |

| Name of Constituent Fund | Sun Life MPF Global Bond Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.748% |

| Class B | Up to 1.548% | |

| No Class of Unit | N/A | |

| No. | 6 | |

| Name of Constituent Fund | Sun Life MPF Hong Kong Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.748% |

| Class B | Up to 1.548% | |

| No Class of Unit | N/A | |

| No. | 7 | |

| Name of Constituent Fund | Sun Life MPF Stable Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.748% |

| Class B | Up to 1.548% | |

| No Class of Unit | N/A | |

| No. | 8 | |

| Name of Constituent Fund | Sun Life MPF Balanced Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.748% |

| Class B | Up to 1.548% | |

| No Class of Unit | N/A | |

| No. | 9 | |

| Name of Constituent Fund | Sun Life MPF Growth Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.748% |

| Class B | Up to 1.548% | |

| No Class of Unit | N/A | |

| No. | 10 | |

| Name of Constituent Fund | Sun Life MPF Asian Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.893% |

| Class B | Up to 1.693% | |

| No Class of Unit | N/A | |

| No. | 11 | |

| Name of Constituent Fund | Sun Life MPF Multi-Sector Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.778% |

| Class B | Up to 1.548% | |

| No Class of Unit | N/A | |

| No. | 12 | |

| Name of Constituent Fund | Sun Life MPF Greater China Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | Up to 1.943% |

| Class B | Up to 1.743% | |

| No Class of Unit | N/A | |

| No. | 13 | |

| Name of Constituent Fund | Sun Life MPF Global Low Carbon Index Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | N/A |

| Class B | N/A | |

| No Class of Unit | Up to 1.10% | |

| No. | 14 | |

| Name of Constituent Fund | Sun Life MPF European Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | N/A |

| Class B | N/A | |

| No Class of Unit | Up to 1.305% | |

| No. | 15 | |

| Name of Constituent Fund | Sun Life MPF US Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | N/A |

| Class B | N/A | |

| No Class of Unit | Up to 1.285% | |

| No. | 16 | |

| Name of Constituent Fund | Sun Life MPF US & Hong Kong Equity Fund | |

| Management fees⁶ (as a % of p.a. of NAV) | Class A | N/A |

| Class B | N/A | |

| No Class of Unit | Up to 1.103% | |

| No. | 17 | |

| Name of Constituent Fund | Sun Life MPF Core Accumulation Fund | |

| Payment for services relating to DIS§ (as a % of p.a. of NAV) | Up to 0.733% |

| No. | 18 | |

| Name of Constituent Fund | Sun Life MPF Age 65 Plus Fund | |

| Payment for services relating to DIS§ (as a % of p.a. of NAV) | Up to 0.733% |

§ "Payment for services relating to DIS"includes fees paid or payable for the services provided by the trustee, custodian, administrator, investment manager (including fees based on fund performance, if any) and sponsor or promoter of the Scheme, constituent funds and in the case of DIS Funds, the underlying APIs, and any of the delegates from these parties and such fees are calculated as a percentage of the net asset value of a fund. In the case of the DIS Funds, payment for services payable to the parties named above, or their delegates, can only (subject to certain exceptions in the MPFS Ordinance) be charged as a percentage of the net asset value of each of the DIS Funds and its underlying APIs. These payments for service are also subject to a statutory daily limit equivalent to 0.75% per annum of the net asset value of each of the DIS Funds which applies across both the DIS Funds and its respective underlying APIFs.

For more details about DIS, please refer to the MPF Scheme Brochure of the Scheme or access Sun Life's website at www.sunlife.com.hk to visit our DIS dedicated webpage.

The above fund management fees and payment for services relating to DIS do not reflect all costs and expenses to be paid by the scheme members. For more details of the management fees, payment for services relating to DIS and other applicable fees, charges and expenses of the constituent funds, please refer to the MPF Scheme Brochure of the Scheme.

Flexible and Convenient Services Provided by BestServe

Wholly owned by Sun Life Financial, BestServe Financial Limited (“BestServe”) has over 20 years of pension administration experience in Hong Kong. As of end of June 2020, BestServe provides third-party pensions administration services to about 760,000 customers with assets of over HK$106.1 billion, and serves employees, self-employed persons, employers and providers of Mandatory Provident Fund Schemes and Occupational Retirement Schemes.

Online Pension Services Centre

Online Pension Services Centre is an internet tool to assist employers and members to manage their MPF account more efficiently.

| Online Services for Employers | Online Services for Members |

|---|---|

| Employer Information | Change Personal Information |

| Contribution History | Account Transaction Details and Account Summary |

| Online Remittance Statement | Member Benefit Statement |

| Long Service Payment / Severance Payment Calculator | Online Change Of Investment Mandate and Fund Switching |

| Employer Statement | Change Of Investment Mandate and Fund Switching History |

| Outstanding Surcharge Information | Online Transaction Log and Details |

| Online Transaction Log and Details | Frequently Used Forms |

| Frequently Used Forms | Member Information Guide |

24-hour Interactive Voice Response System (IVRS) & Pension Services Hotlines

You may call our Customer Service Representative via our Pension Services Hotline on 3183 1888 during office hours, from Monday to Friday at 9:00am to 6:00pm and Saturday at 9:00am to 1:00pm (except public holidays) or use our 24-hour IVRS offering the following services:

- Administration procedures

- Change of investment choices

- Scheme account information

- Scheme account information

- Investment performance

- Forms by fax

e-Alert Service for Member

By providing your mobile phone number or email address, you can enjoy our e-Alert Services. With this value-added service, you will receive a SMS or email notification whenever your fund switching instruction has been completed or your transfer of accrued benefits has been successfully transferred to your MPF account.

Payroll Software for Employer

We understand how busy human resources departments are handling the large amount of day-to-day work. To support you in managing MPF administrative tasks, like handling multiple MPF schemes, preparing MPF contribution and employee termination documents and keeping all contribution records, we have partnered with Asia Pacific Soft Limited to offer Alpha Human Resources Management System⁷. From now on, MPF administration will be nearly effortless.

- With regard to the Sun Life MPF RMB and HKD Fund, the Investment Manager has delegated the investment management functions to Invesco Hong Kong Limited.

- For further details, including the investment objective and investment mix of each of the constituent funds, please refer to Section 3.4 – “Investment and Borrowing” of the MPF Scheme Brochure of the Scheme.

- All rights in the FTSE MPF Hong Kong Index (the “Index”) vest in FTSE International Limited (“FTSE”). “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence. The Sun Life FTSE MPF Hong Kong Index Fund (the “Fund”) has been developed solely by Sun Life Trustee Company Limited (the “Trustee”). The Index is calculated by FTSE or its agent. FTSE and its licensors are not connected to and do not sponsor, advise, recommend, endorse or promote the Fund and do not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. FTSE makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put by the Trustee.

- The Sun Life AM Global Low Carbon Index Fund (Underlying Fund) has been developed solely by Sun Life Asset Management (HK) Limited. The Underlying Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE Custom MPF Developed Selected Countries ESG Low Carbon Select Hedged Index (Underlying Index) vest in the relevant LSE Group company which owns the index. “FTSE®”, “Russell®”, “FTSE Russell®” are trademarks of the relevant LSE Group company and are used by any other LSE Group company under license.

The Underlying Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the index or (b) investment in or operation of the Underlying Fund. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Underlying Fund or the suitability of the Underlying Index for the purposes to which it is being put by Sun Life Asset Management (HK) Limited.

- For more details of asset allocation of Fund Cruiser, please refer to the MPF Scheme Brochure of the Scheme.

- If the member’s birthday falls on a non-business day, the MPF portfolio will be rebalanced on the first business day after the birthday.

- “Management fees” includes fees paid to the trustee, custodian, administrator, investment manager (including trustee and administration fee as well as investment management fee of the relevant APIF/ITCIS) and sponsor of a scheme for providing their services to the relevant fund. They are usually charged as a percentage of the net asset value of a fund. The investment management fee of the relevant APIF/ITCIS is borne by the Investment Manager, the Sponsor or their affiliate; in that case, the Scheme need not bear the investment management fee paid by the Investment Manager.

- Alpha Human Resources Management System is an application software developed and owned by Asia Pacific Soft Limited. Asia Pacific Soft Limited is neither an agent of Sun Life Hong Kong Limited nor a member of Sun Life Financial group of companies. Use of AlphaHRMS will be subject to Asia Pacific Soft Limited’s terms and conditions. Please read the terms and conditions carefully prior to deciding whether to use the AlphaHRMS.

Disclaimer

Investment involves risks and past performance is not indicative of future performance. Investment return may rise as well as fall due to market condition and currency movement which may affect the value of investments. The value of units may vary due to changes in exchange rates between currencies. Emerging markets may involve a higher degree of risk than in developed markets and are usually more sensitive to price movements.

The return of Sun Life MPF RMB and HKD Fund may be adversely affected by movements in RMB exchange rates as well as foreign exchange controls and repatriation restrictions imposed by the Chinese government as the fund invests part of its assets in RMB denominated money market and debt instruments.

Issued by Sun Life Hong Kong Limited (Incorporated in Bermuda with limited liability)

Quick Links

Tools & calculator

If you want to compare the performance of different MPF constituent funds, please visit MyMPFChoice.com – a free performance comparative platform.